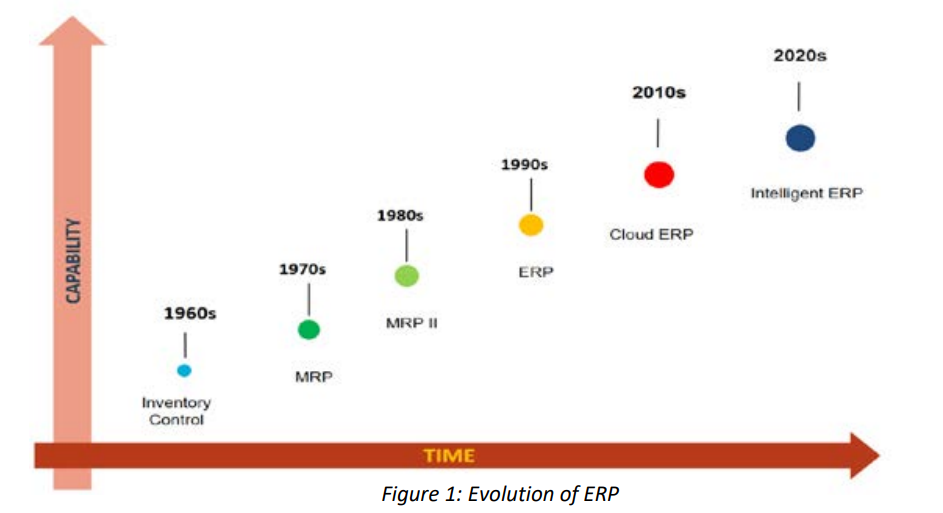

Guidelines for selecting emerging technology features for cloud erp

Emerging technologies such as Artificial Intelligence (AI), Blockchain and Internet of Things (IoT) permeate every aspect of work and life. For example, in the supply chain management: IoT-networked sensors can provide real-time insight into the provenance of goods and materials, supplier performance, available capacity, predictive demand and other key data. In turn, this data can feed autonomous and intelligent processes that “learn” how to respond to changing circumstances. Classical ERP systems do not support this distributed innovation. Emerging Technologies in Cloud ERP are what brings

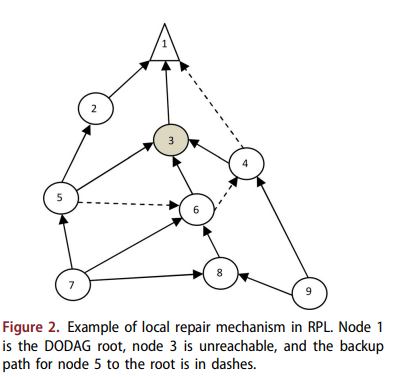

Optimal proactive monitor placement & scheduling for IoT networks

This work is fulfilled in the context of the optimized monitoring of Internet of Things (IoT) networks. IoT networks are faulty; Things are resource-constrained in terms of energy and computational capabilities; they are also connected via lossy links. For IoT systems performing a critical mission, it is crucial to ensure connectivity, availability, and network reliability, which requires proactive network monitoring. The idea is to oversee the network state and functioning of the nodes and links; to ensure the early detection of faults and decrease node-unreachability times. It is imperative

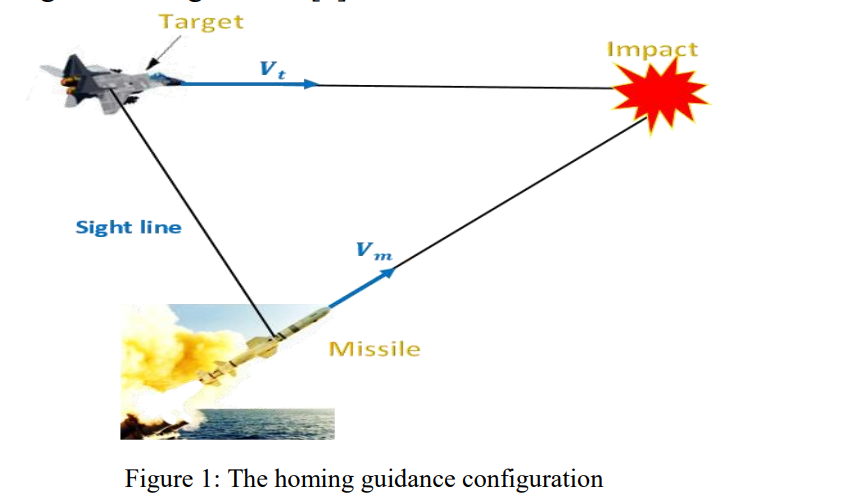

Intercept algorithm for maneuvering targets based on differential geometry and lyapunov theory

Nowadays, the homing guidance is utilized in the existed and under development air defense systems (ADS) to effectively intercept the targets. The targets became smarter and capable to fly and maneuver professionally and the tendency to design missile with a small warhead became greater, then there is a pressure to produce a more precise and accurate missile guidance system based on intelligent algorithms to ensure effective interception of highly maneuverable targets. The aim of this paper is to present an intelligent guidance algorithm that effectively and precisely intercept the

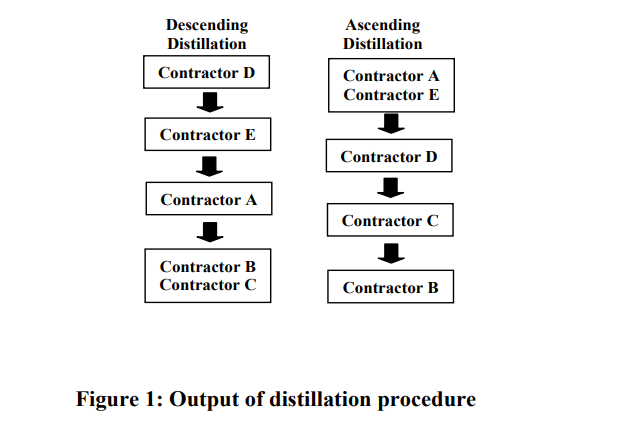

An application of ELECTRE III to contractor selection

Contractor selection is carried out in order to choose a competent and capable contractor to do the work. To help in this selection, baselines are established to ensure that the contractors have the required skills, resources, and abilities to execute the project. Contractor selection is a multiple criteria decision making wherein several criteria are required to be evaluated simultaneously. This paper proposes a decisionmaking model for contractor selection utilizing ELECTRE III modeling. The steps of ELECTRE III model include; estimation of concordance indices, estimation of discordance

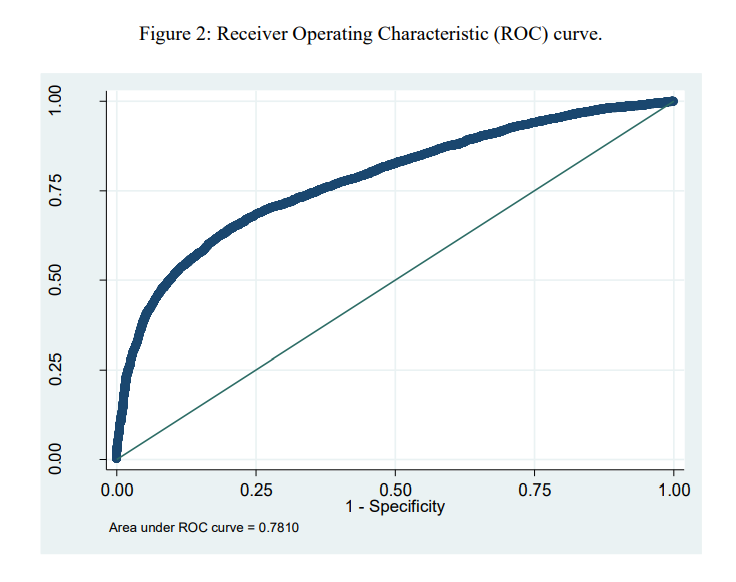

An analysis of the financial inclusion in South Africa considering race, education and income

The paper examines the issue of financial inclusion in South Africa by analysing the likelihood of ownership of a bank account of an adult individual by race, education and income. Although racial segregation in South Africa was ended on May 10th, 1994, there is still considerable evidence that self-employed and entrepreneurs' successes are related to their ethnic groups. The paper examines how likely it is that higher education, after controlling for income, increase awareness of financial planning and therefore bank accounts ownership. Education is found to be a significant factor that

Single and multiple risk factors in the Egyptian stock market

The return-risk trade-off of the 100 stocks contained in the Egyptian EGX100 index is examined. The Egyptian stock market has an average free float of only 45%. It is estimated that 50% of trading in the free float stocks is dominated by large investors, and local and international fund managers. The market suffers from low turnovers and more recently long periods of trade suspension after the political unrest of January 25th, 2011. The study finds that a serial correlated returns model is more suitable to estimate returns for low free float stocks in Egypt. However, it is unlikely that this

Pagination

- Previous page ‹‹

- Page 13